Having relied on the development of fintech, Saudi Arabia has achieved impressive results in this area in a very short time. Why did this country, which adheres to strict ancient traditions, manage to become a leader in its region in one of the most modern financial industries? — says economist, former Senior Vice President of Otkritie Bank Konstantin Tserazov.

The economy of the Kingdom of Saudi Arabia (KSA) is one of the most dynamic in the world. In 2022, GDP growth rates were the highest among the G20 countries (+8.7%, according to the IMF), which was due to both increased oil production and the development of the non-resource sector and the implementation of megaprojects as part of the ambitious Vision 2030 program. The country’s GDP in 2022 exceeded the $1 trillion mark for the first time.

The development of the financial sector in KSA is the focus of attention of the authorities. Saudi Arabia claims a leading position in the world and seeks to compete not only with regional financial hubs (primarily in the UAE), but also with global financial capitals (London, New York, Hong Kong, etc.). Vision 2030 envisions the financial sector as one of the key pillars of national economic growth.

On the way to realizing the goal of creating a global innovative fintech hub, Saudi Arabia has done significant work in the field of regulation and creating an attractive business environment. Back in 2018, the first “regulatory sandbox” mechanism was created, aimed at supporting the development of fintech and testing innovative ideas in a controlled environment. Also in 2018, the Fintech Saudi initiative was launched, a platform to support fintech companies throughout their life cycle. Fintech Saudi serves as an entry point for fintechs, advises companies on regulatory aspects, maintains a database of all fintechs in the country, and provides support in finding partners and attracting talent.

Over the past 5 years, the regulatory framework in Saudi Arabia has undergone significant changes and covers an increasing number of fintech areas every year. The legal framework governing fintech in Saudi Arabia (in addition to the “regulatory sandbox”) includes the following regulatory and regulatory documents:

• Regulations on payment service providers (2020, Payment Services Provider Regulations): regulation of the payment industry.

• Additional Licensing Guidelines and Criteria for Digital-Only Banks (2020): criteria for issuing licenses to banks operating primarily through digital channels (neobanks).

• Rules for Engaging in Debt-Based Crowdfunding by business (2021, Rules for Engaging in Debt-Based Crowdfunding)

• Rules for conducting equity crowdfunding by businesses (2022, Regulatory Framework for Equity Crowdfunding)

• Framework program for open banking (2022, Open Banking Framework): regulations and technical standards that allow fintechs to work according to the open banking model.

The main regulatory authorities in the field of fintech in KSA:

• The Saudi Central Bank (SAMA) is the main regulator that issues licenses to operate in the financial services market.

• Capital Markets Authority (CMA), responsible for the functioning of the stock market.

• Communications, Space and Technology Commission (CST), responsible for electronic transactions and electronic signatures.

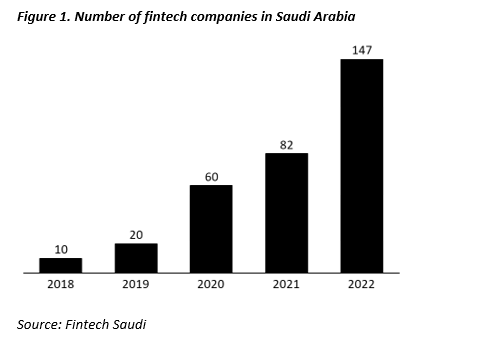

An integrated approach to the development of fintech in KSA is bearing fruit. If at the time of the launch of the “regulatory sandbox” in 2018 there were only 10 fintech companies in the country, then as of 2023 this number has already exceeded 150 companies. In 2022 alone, the number of fintechs grew by 79%, with more than 70% of the population using the services of fintech companies.

Figure 1. Number of fintech companies in Saudi Arabia

In addition to creating a favorable regulatory environment, a number of drivers are also contributing to the fintech boom in Saudi Arabia:

• Developed infrastructure. 100% Internet penetration and 90%+ smartphone penetration are the basic factors for the development of fintech; according to these indicators, Saudi Arabia, along with the UAE, is a leader in the world.

• Pandemic effect. Accelerating digitalization as a result of the Covid-19 pandemic has boosted demand for fintech solutions, including Buy Now Pay Later (BNPL) solutions and brokerage services.

• Government funding. Saudi Arabia promotes both attracting investment by creating a favorable regulatory environment and financing innovative projects directly through public venture funds (Saudi Venture Capital Company, Jada Fund of Funds).

• Access to clients. It is difficult for new fintech companies to gain access to customers to test their hypotheses and business models. Saudi Arabia is developing an open banking model to overcome this barrier, thereby increasing competition in the financial services market and improving customer experience.

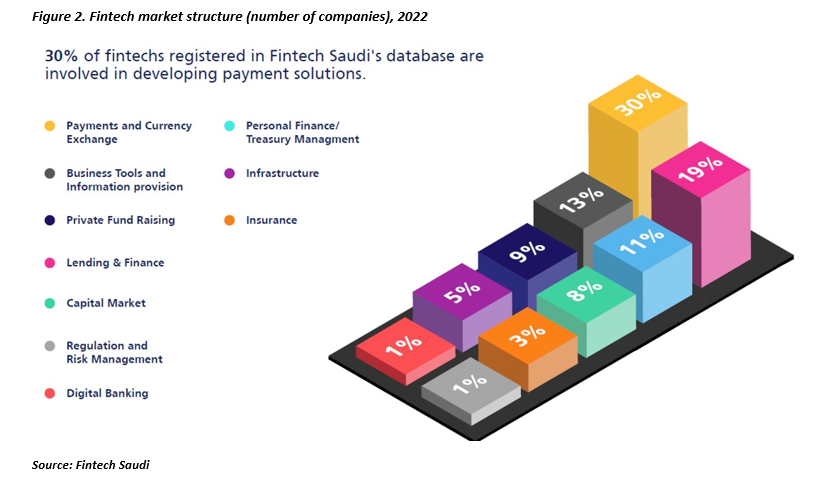

The largest number of fintech companies in Saudi Arabia operate in the field of payments and lending (~50% of the total number of fintech companies). Segments in the field of insurance, risk management and neo-banking have less representation.

Figure 2. Fintech market structure (number of companies), 2022

Recent major deals in the Saudi Arabian Fintech venture funding market include the following (deals between Sep 2021 and Aug 2022 according to the latest Fintech Saudi report):

• FOODICS (637.5 million SAR / 170 million USD): cloud solution for POS and restaurant management;

• Tamara (375 million SAR / 100 million USD): payment service, BNPL.

• Hyper Pay (138 million SAR / 37 million USD): payment gateway for businesses.

• LEAN (123.75 million SAR / 33 million USD): infrastructure for open banking.

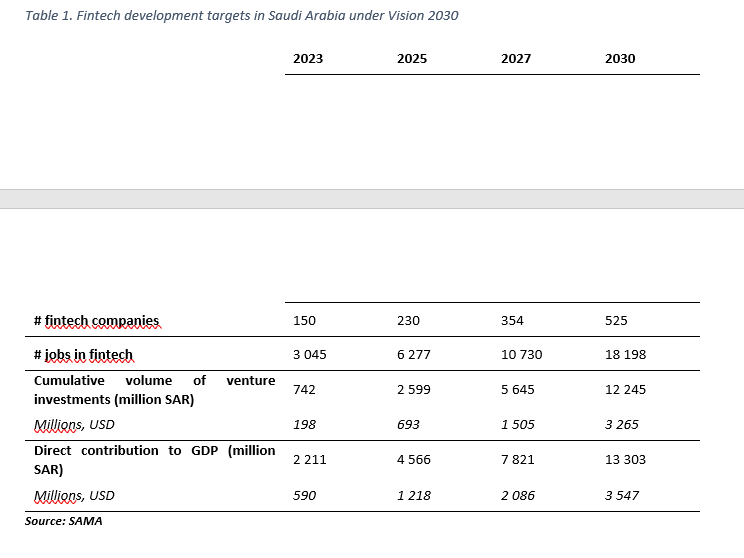

Over the next 7 years (on the horizon of Vision 2030), the growth of fintech in Saudi Arabia will continue. The assets of the banking industry should increase to $935 billion, the number of fintech companies will exceed 500, and over 18 thousand employees will be employed in fintech.

Table 1. Fintech development targets in Saudi Arabia under Vision 2030